An insurance advisor is an individual who acts as a bridge between the insurance company and customers. The advisor represents the insurance company and helps individuals buy the company’s products. Thus, the advisor acts as the face of the insurance company for customers. For every product that the advisor sells, he earns a commission on the amount of premium of that policy.

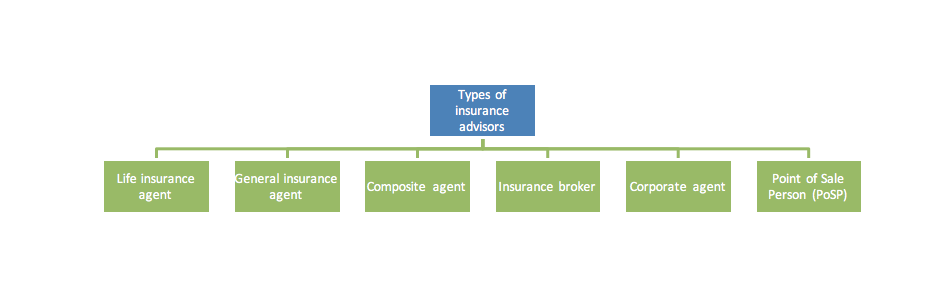

Types of insurance advisors

There are various types of insurance agencies which are available. You can become any of the following types of advisors –

- Life insurance agents are those who represent one life insurance company and sell products of that particular company.

- General insurance agents represent one general insurance company and sell all types of general insurance products offered by that company.

- Composite agents are those who can sell life insurance as well as general insurance policies.

- Insurance brokers are those who are licensed to represent multiple insurance companies. Brokers can sell insurance plans of different types of companies.

- Corporate agents are companies which sell insurance products. Corporate agents can also represent multiple insurance companies.

- Point of Sale Person (PoSP) is a relatively new concept of the insurance industry. A PoSP is an individual who is allowed to sell both life and general insurance policies of multiple companies on a single PoSP license. After getting a PoSP license, the individual can sell insurance policies.

Why is selling insurance a rewarding career?

Selling Insurance promises some of the best benefits which include the following –

- You can earn unlimited income from the commission you generate. There is no limit on the number of insurance policies that you can sell. Thus, if you sell lots of insurance policies, your earning increases manifold.

- Selling insurance policies is like a business wherein you don’t have to put in long hours of work. You can work as per your convenience at any time which suits you and be your own boss.

- Selling insurance does not require huge amounts of capital. You just have to pay a registration fee to register for the agency, clear the exam and start your own agency business easily. In fact, in many cases, like in case of becoming a PoSP, the registration fee is also negligible.

- Anyone who has completed Class 10 formal education and is more than 18 years of age can become an insurance advisor and sell insurance.

Besides these benefits, the future of being an advisor is also bright with multiple advantages and promises. These can be summarized as:

- Renewal incomes through renewal commissions

Selling insurance does not mean that you get to earn a commission in the first year only. As the insurance policy is renewed by your customers, you earn renewal commissions too. So, with a one-time effort of selling insurance, you can generate renewal incomes over years to come. This renewal commission can also become your annuity as it pays an income regularly.

- International recognition

There are three types of international convocations which are held specifically for the best performing insurance advisors round the world. Advisors from all around the world participate in these convocations if they have achieved the qualifying business target. The three international recognitions are as follows –

- MDRT – Million Dollar Round Table

- COT – Court of the Table

- TOT – Top of the Table

So, selling insurance not only provides attractive commissions, it also gives you rewards and recognitions not only nationally but internationally too.

So, being an expert in insurance and providing guidance to purchase the right kind of insurance policy and also selling the insurance policies is not a great career option, but is lucrative too as it has a great future. You can, therefore, establish your career as an insurance advisor and grow it over the years.