The war between ULIPs and mutual funds has existed ever since ULIPs were launched back in the last decade. Investors and financial experts alike have always debated on the pros and cons of both these investment avenues. Your clients too must have a favourite in their investment portfolio. Both ULIPs and mutual funds have the same investment structure. The money invested is pooled together and then invested in various stocks and shares. The only addition in a unit linked plan is the life insurance cover which is absent in mutual funds. Besides this obvious difference, there are other differences too if you look closely. Here are some of them –

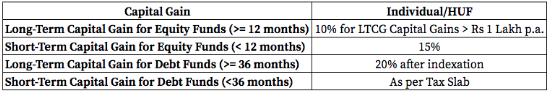

According to the Budget proposition in F.Y. 2018–19, mutual funds would be taxed at a minimum of 10%. Thus, it is not a tax-free instrument anymore. Details about Capital Gains taxation for Mutual Funds are:

Now that you know the difference, how can you judge whether ULIPs are better or mutual funds? Let’s strategize –

Strategy 1 — ULIPs

ULIPs give you a combination of mutual fund like investments and life insurance coverage under one plan. They thus fulfil two purposes and can be pitched to your clients using this USP. Other than this, here are the pros and cons of ULIP investments for you to know –

Pros

- Tax Benefit:

The premiums invested, partial withdrawals made, surrender value and the plan benefits are all eligible for tax benefit. The premium is tax free under section 80C and the maturity proceeds are tax free U/S 10(10)D

- Tax Advantage:

Switching from equity to debt funds and vice versa can be done without having to worry about Short-Term or Long-Term Capital Gains taxation, unlike Mutual Funds

- Forced Savings:

Since there is a lock-in period of 5 years, ULIPs help in creating forced savings which help in fulfilling your financial goals. Thus, insurance plans usually continue for the longer duration unlike other investment products.

- Low Charges:

In many online plans, the allocation charges are nil which increases the premium invested

Cons

- Charges:

Some ULIPs may have a higher charge structure. So, one need to choose carefully with the purpose in mind.

- Front Loading of Charges:

ULIPs usually have most of the charges in the first few years of the policy. Thus, ULIPs need to be continued for longer to reap the maximum benefits. Thus, ULIPs come with a long-term perspective.

Strategy 2 — mutual funds + term insurance

This strategy tries to make mutual fund investments equal to ULIPs by adding in a term plan with mutual fund investments. Here are the strategy’s pros and cons –

Pros

- Higher Coverage:

You get a higher coverage with a term plan

- Tax Benefit:

ELSS schemes also allow you to claim 80C tax deduction on the money invested

- Higher Choice of investments:

Since Mutual Fund are pure investment schemes, there are higher options available for investment with a specific objective in mind.

- Liquidity:

Mutual fund schemes are quite liquid and you can withdraw funds whenever needed

Cons

- Higher Premium:

Buying a separate term plan would result in higher premium outgo since the investment part needs to be addressed by Mutual Funds, where there is no life coverage.

- Tax Deduction:

Only investment in an ELSS scheme qualifies for tax deduction. Investment in other mutual funds do not qualify for tax benefit. Also, on redemption, the money becomes taxable. Any short-term or long-term capital gain made from equity or debt mutual funds is taxable in your client’s hands. Thus, switching from equity to debt or vice versa may attract capital gains taxation unlike in ULIPs, where there is no tax liability.

- Low Continuity:

Because of high liquidity, there is always a temptation to withdraw the fund. Due to this tendency, enough savings are not created for fulfilling financial goals.

Although mutual funds have high returns and loads of fund options, one cannot ignore the tax implication on them. Even equity mutual funds have become taxable with the recent budget announcements.

So, at this time, you can position ULIPs as an effective investment avenue for your clients. ULIPs provide very good returns over a long-term horizon if managed well along with tax efficiency. Make your clients see the relative pros and cons of both strategies and help them make an informed decision.

Also read more about tax saving on health insurance

Also read more about Budget 2018 – Impact on insurance industry