When health insurance claims occur, many of your clients are stumped with the process which should be followed. They don’t know whether their claim would be treated as cashless or reimbursement and what would be the respective processes. Even if you have confusions about getting your clients’ health claims settled, here is a step-by-step guide on the types of claims and their process. But first, a word about the types of claims–

- Cashless claims are those under which the insurance company settles the hospital bills directly with the insurance company. This claim facility is available if your clients get treatments at a hospital which is tied up with the insurance company (also called network hospitals)

- Reimbursement claims are those in which your clients would have to pay for their medical bills themselves. Then they have to present the claim to the insurance company which would reimburse the claim. Reimbursement claim generally happens when treatments are taken at a non-networked hospital.

Now, here’s a look at the claim process is details for both types of claims-

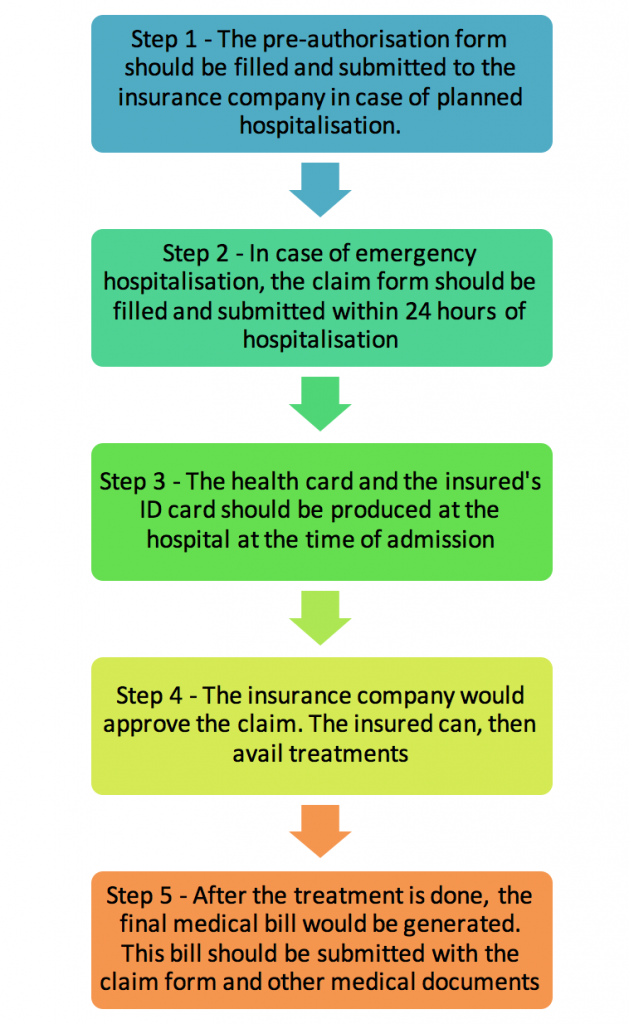

For cashless claims

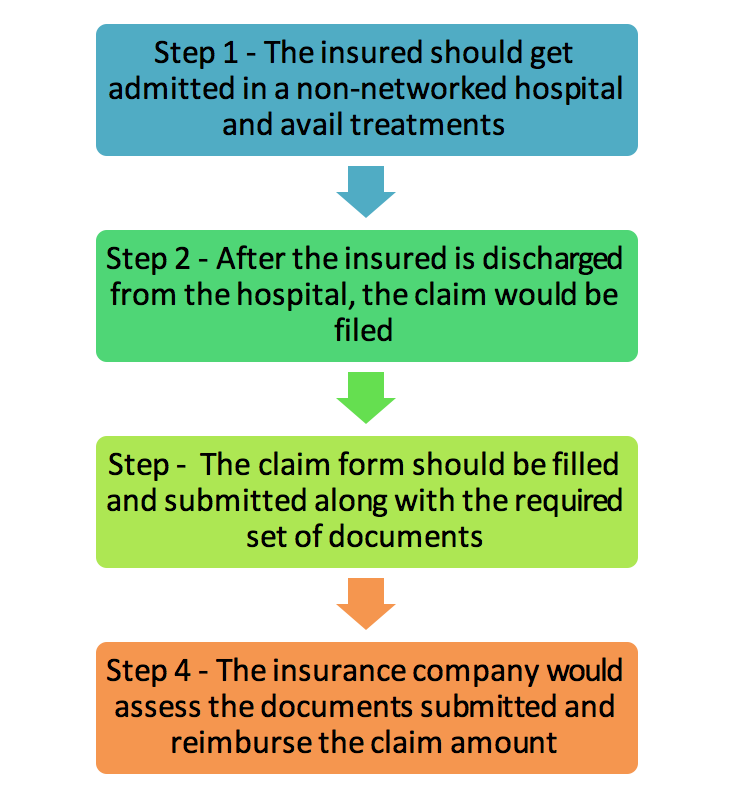

For reimbursement claims –

Now that you know the basic steps of making cashless and reimbursement claims, here are some insights on how you can make the claim process easier for your clients–

4 tips for smooth processing of cashless claims

- Ensure the submission of the pre-authorisation form within the specified time frame

In case of planned hospitalizations, the form should be submitted at least 3-4 days in advance so the claim is approved easily and your client’s claim gets settled at the earliest. The form is an essential requirement which informs the insurance company of a possible claim and allows it to prepare for claim approvals.

- Do not forget the health card and ID proof at the time of admission

The health card issued by health insurance companies act as proof of coverage. It contains a unique customer number which lets the TPAs of insurers find out the plan details for cashless coverage. Moreover, the ID proof is also required to identify the individual getting admitted and making a claim. Your clients should, therefore, not forget to carry these essential documents.

- Initial approvals require follow-ups

After the pre-authorisation form is submitted, the approval of the claim should be followed up when your client is being hospitalized. Following-up helps in making the claim settlement smoother.

- A final approval should be sought during discharge

Before the insured gets discharged from the hospital, it should be checked that the final claim approval has been received from the insurance company and that the claims have been settled.

Cashless claims of public health insurance companies come with the benefit of PPN rates. Do you know what are PPN rates in health insurance? Click here to know more about PPN rates.

4 tips for smooth processing of reimbursement claims

- All the necessary documents should be at the disposal of your client

Reimbursement claims require detailed documents which help the insurance company understand the illness suffered and the associated medical bills. Thus, your clients should have all the original documents arranged in a chronological order according to their respective dates. Such documents, when arranged chronologically, would include the following –

- A medical practitioner’s advice to seek hospitalization

- Reports of the diagnostic tests conducted and prescriptions of medication taken before hospitalization

- Bills, money receipts, doctor’s prescriptions, etc. up until the date of admission

- All bills, test reports, doctor’s certificate for the period of hospitalization

- Discharge summary

- Post-hospitalization bills of doctor’s consultations, medications, and diagnostic tests conducted

- Fitness certificate from the doctor

Besides these documents, the claim form and the original policy document should also be submitted to the insurance company.

- A covering letter is also required

A covering letter is also required with the claim form and the above-mentioned documents. The letter details the illness suffered, the hospital was chosen for treatment, treatments received and other facts related to the claim. The letter should clearly state the list of documents being submitted and that the documents are arranged in a chronological order.

- Copies of all submitted documents should be retained

Advise your clients to make photocopies of all documents which are being submitted with the insurance company. Having photocopies would ensure that your clients also have a record for the claim that they are making.

- Double checking the documents to be submitted

Before the documents are submitted to the insurance company your clients should double check each document to see if there is any mistake or omission committed by them. Double checking would ensure that the claim process is not delayed due to documentation error and the claim would be settled easily.

So, now you know the detailed claim process, the documents required and also important tips about easy claim settlements. Educate your clients about the same so that their health insurance claims are settled without any hiccups.