August 2018 proved yet another productive month for the insurance industry. Both life insurers and general insurers saw positive growth in the premiums collected during the month of August 2018 compared to August 2017. The reason behind this growth story can be contributed to the rising awareness of individuals to insurance and its importance. More and more individuals are purchasing term insurance plans for creating a secured financial future for their families.

In the general insurance industry, health insurance and motor insurance products are quite popular among individuals. A report published by the Insurance Regulatory and Development Authority shows the growth achieved by insurance companies in August 2018 compared to August 2017. Let’s see how the companies performed–

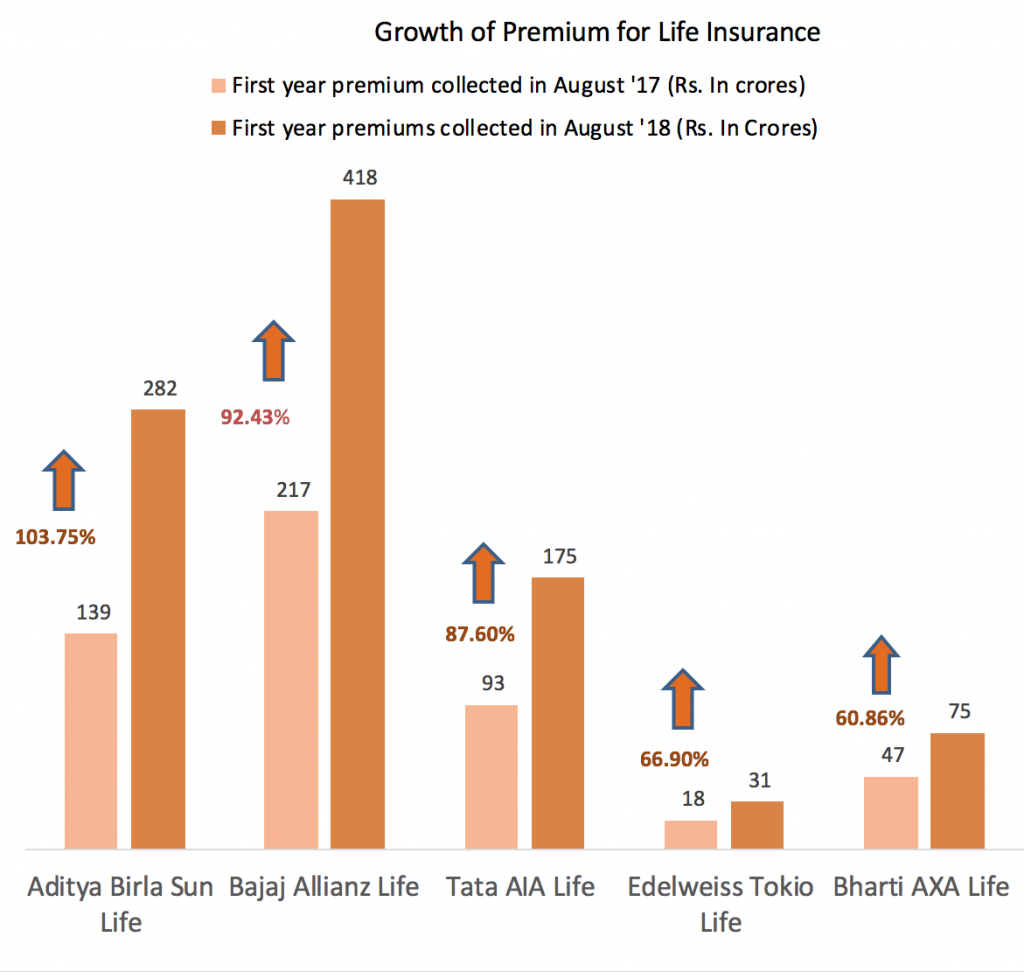

Life insurance companies

Amidst life insurance companies, Aditya Birla Life almost doubled its premium collection in August 2018 compared to August 2017. Bajaj Allianz and TATA AIA Life also followed closely behind. LICI, however, posted a negative growth. While in August 2017 it earned a premium of INR 13382.30 crores, in August 2018 its premium collection dropped to INR 13122.12 crores giving a negative growth rate of -1.94%. However, other insurance companies had a good month as the graph depicts-

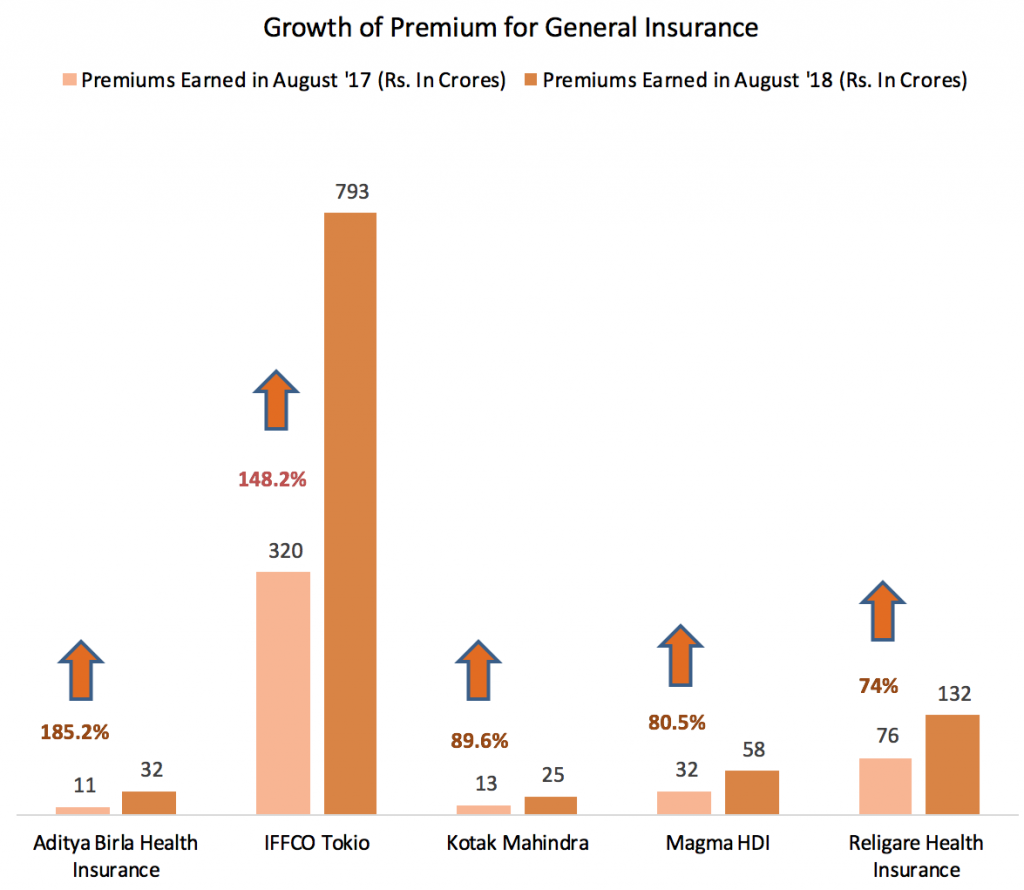

General insurance companies

In the case of general insurance companies, two companies posted more than a double growth in the premium collected. Both Aditya Birla Health Insurance Company and IFFCO Tokio General Insurance Company had impressive growth rates. Following them are Kotak Mahindra, Magma HDI, and Religare Health Insurance.

Given the exceptional performance of both life and general insurance companies, it can be safely said that the insurance industry is poised to grow in the coming years. The average customer is no longer hesitant in buying insurance plans suiting his/her needs giving you, the insurance middleman, the potential to grow your business.

Click here to read the growth of insurance business: July 2018 vs July 2017