Sanjay works in an MNC in Pune, he has a group policy from his organization that covers him and his family for a total of Rs. 200,000. Unfortunately, the family met with an accident while on a road trip. Though the family was covered by the corporate policy, the total insurance cover available to the family was not enough to take care of the hospitalization cost for all of them. Sanjay had never thought of buying any health insurance policy because he had assumed that his company health insurance policy would be sufficient to take care of any unforeseen medical exigency.

Just like Sanjay many of your prospective clients may feel buying a health insurance policy is not required for multiple reasons; having a corporate health plan is just one of the many reasons. So what are the main reasons for your clients say no to medical insurance.

Five Reasons Why Clients Say “No” to Health Insurance Plans?

Here are what we think are the most common reasons for people who you approach, may say to no to buying a health insurance plan.

1.Lack of Awareness:

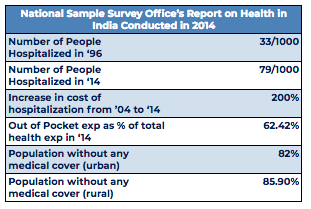

This may be the most common reason for an individual saying no to buying a health insurance plan. They may not have paid enough attention to changing demographics and rising health cost. Not only the cost of medical expenditure is spiralling out of control but people are living longer and also the big traditional family set up is on the decline. All these factors mean that people cannot just rely on your family or savings to care for them when an illness strikes. The table alongside shows the increase in expenditure as well as Out of Pocket Payment due to lack of adequate amount of health cover.

2.The Optimism Bias:

Even though your clients may be reading about the increasing cost of medical treatment or about the rise in the number of people requiring hospitalization they may feel that it’s not going to happen to them. They may assume that no major harm will befall them so health insurance is not required. Your clients may believe that they are young and/or healthy so medical insurance is not necessary. The table shows the rise in the number of people being hospitalized and also the rise in the cost of hospitalization. It also highlights the high percentage of medically uninsured people in our country.

3. Reliance on Group Health Plans:

As we saw in Sanjay’s example above, often your clients may tell you that they do not require a health insurance plan because they already have a group plan provided by the organization that they work in. Often this plan may not be adequate to take care of the family’s needs in the time of distress or what happens if the client is out of job or in between jobs. In such a scenario, they may find themselves vulnerable without any medical plan covering them.

4.Unnecessary Expenditure with No Returns:

People may shy from buying a policy also because they may feel that it’s an unnecessary expenditure and it offers no returns. They may believe that it makes more sense to invest in instruments that can offer them returns and this corpus can help them take care of their medical expenditure if required. They may also find the cost of the insurance plan to be too high and especially so since it’s a recurring expenditure and needs to be made every year.

5.General Mistrust of Agents and Insurance Companies:

Your clients may also feel that the agent and the company have just one agenda which is to push the most expensive product on to them. They may feel that may end up buying a policy even if they do not require it or there may be miss-selling and they may be saddled with a product-led without being fully aware of the fine print like riders, exclusions and so on. They may also have misgivings about insurance companies not settling the claim or taking too long to provide the benefits or they may have some negative opinion about the entire process of filing for a claim.

What Can You Do As Agents?

Well, we discussed above a few reasons that may prevent your clients from the buying a health policy. Here are a few ideas to help you deal with it:

- The first thing that you need to do is to make your clients aware of how a medical plan works and why is it required for them and their family.

- Use statistics that help them to understand not only about the increasing cost of medical treatment but also the rise in various ailments and the need for hospitalization.

- Help them get over the optimism bias.

- Make them understand about group plans so that they know who all in the family are covered and to what extent, what is not covered and so on. This will help them understand if they need an additional plan or not.

- It’s very important that you make your client understand that any insurance plan cannot be compared with an investment plan. Also, when calculating the cost of insurance they must factor in the tax benefits it offers.

- Last but not the least; you need to win the trust of your clients. There are so many products with so many details which may overwhelm them. So, understand what their requirement is and offer a product that suits them best. Offer them genuine and useful advice!

Hopefully, the above discussion can aid you in offering your clients useful and optimal solutions that take care of any medical exigency that they may face.

Read more Read more about Did you know that Religare care is one of the best health plans for your clients?

Read more about how to boost insurance sales